We are pleased to release Lodging Taxes In Colorado: A Tool for Community Investment. This toolkit is designed to serve as a guide for elected leaders and local advocates as they seek to utilize HB25-1247.

We are pleased to release Lodging Taxes In Colorado: A Tool for Community Investment. This toolkit is designed to serve as a guide for elected leaders and local advocates as they seek to utilize HB25-1247.

Investing in Colorado’s youngest children isn’t charity—it is basic infrastructure and provides a strong return on investment. Philanthropy alone won’t fix the child care system; it will require additional investment at the local, state, and federal level.

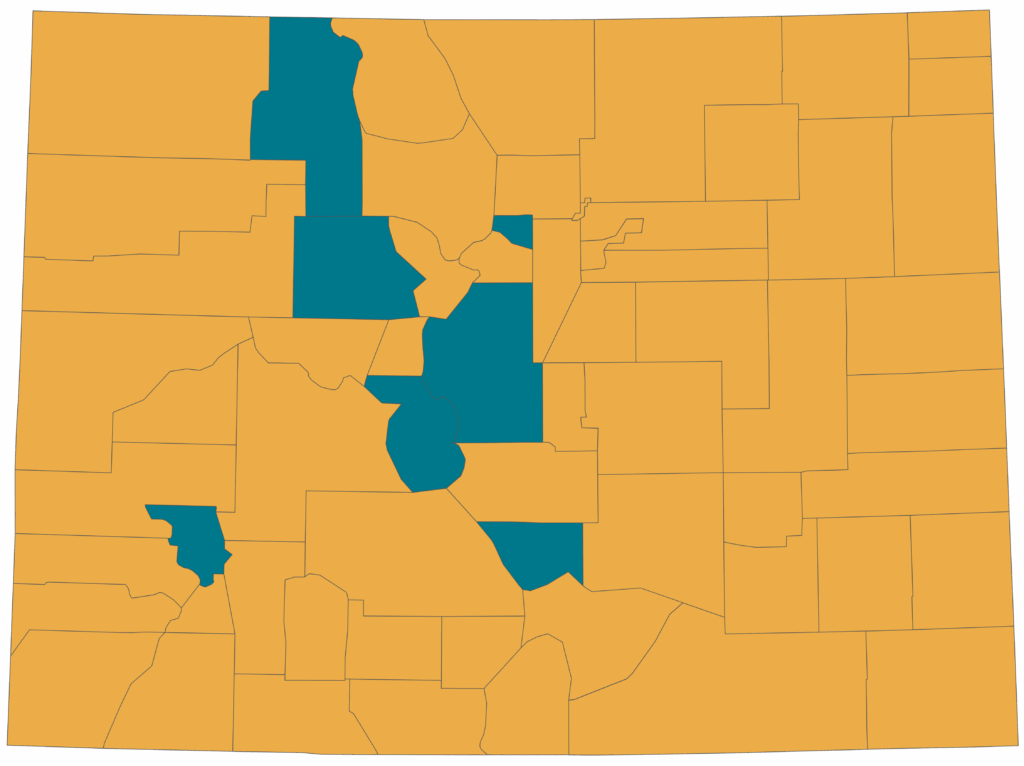

As The Colorado Sun notes in a recent article, many counties are moving forward with increases in lodging taxes to fund local needs. Since 2022, early childhood has been an allowable use of lodging tax funds, and communities like Estes Park, Eagle County, Chaffee County, Gunnison County, San Juan County, and more are using this revenue stream to make significant investments in ECE to ensure that their communities remain livable for families and that parents can participate in the workforce.

Our toolkit is a clear roadmap that highlights the opportunities that lodging taxes present—cataloging important resources, timelines, and best practices to help community leaders who choose to use this tool. We recognize the competing priorities faced by local leaders and hope that this document is helpful as they respond to community needs.

As an example of this support, we commissioned the creation of a report: the 2024 Local Ballot Measure After-Action Review: Reflections from Grand County, La Plata County, and the City of Montrose On Their Lodging Tax Success. We hope that this report and case study serves as a guide for local elected officials and also as a tool for advocates to continue pushing for ECE to be regularly included in future lodging tax questions.

To access additional local financing case studies, webinar recordings, and resources, click here.

Contact Jason Callegari, Director of Initiatives, for more information.